Our Fees. Not For Profit.

Judge Freeman's Decisions

July 3, 2024, Judge Freeman ruled 1) the Sixth and Seventh Amendments were void 2) RCW 64.90 requires a homeowners association and 3) Homestead does not have one. His April 21, 2025 decision directs homeowners how to reclaim fees from the court registry that were collected under the 7th amendment. See Latest News for the Judge’s May 13, 2025 “Findings of Fact, Conclusions of Law, and Order on Remaining Claims Including Invalidating the Sixth and Seventh Amendments to Covenants.”

The Goal / Appeal

Homestead parcel owners still want control over how their restrictive covenants are enforced and how their maintenance fees are spent. The appeal is a continuation of the class action lawsuit and class claims pursuant to the consumer protection act.

Lend Your Voice

Homeowners, thanks to your overwhelming show of approval the court reconsidered its original decision and has certified this as a class action lawsuit.

The Complaint

UPDATE: April 16, 2022 – Court order rules common open space does not include “areas within the golf course.” (Read order here)

The Complaint alleges that Golf course owner 18 Paradise, LLP (Morris Chen) and its management agent MJ Management (Mick O’Bryan and Josh Williams) have wrongfully charged and collected the common area maintenance fee for years. The lawsuit argues that the maintenance fee is tantamount to stealing from homeowners and demands an accounting and a return of any misappropriated funds.

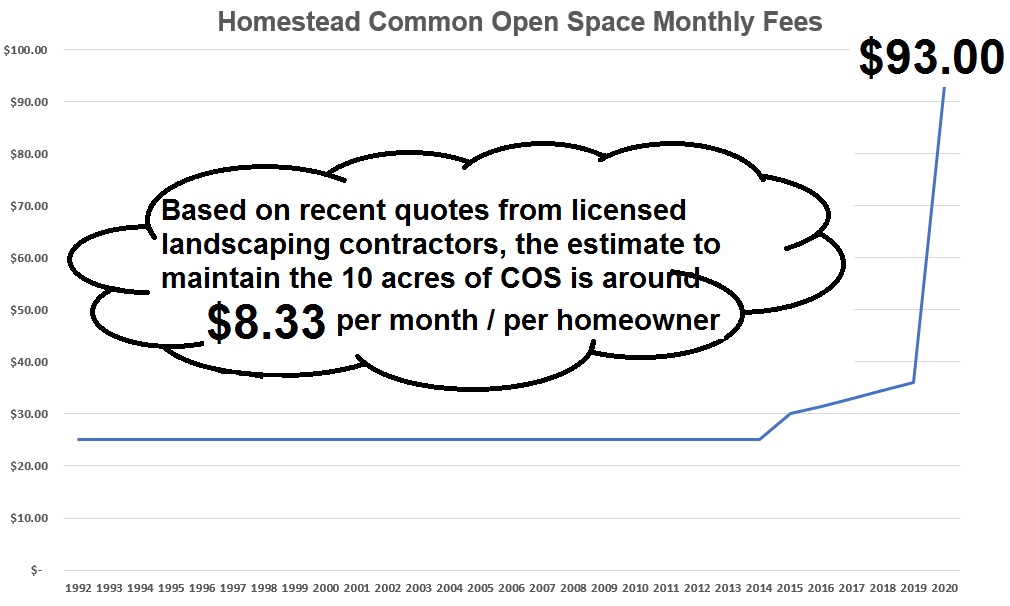

Intended only for common open space maintenance, their fee increase from $36/month in 2019 to $93/month in 2020 (times 600 parcels) exceeds $600,000.

Recent quotes from local landscaping (referenced in diagram) and electrical contractors (not referenced) indicate maintenance fees should only be a fraction of that amount.

What Is A Class Action Lawsuit?

FAQ

WHEN DOES/DID THE COURT ORDER GO INTO AFFECT?

https://homestead-hoa.org/golf-course-sold-october-1-2025/The court order was signed by Judge Freeman on September 15, 2021 and affects maintenance fees from that date. So maintenance fees will revert back to $36/month for the October 2021 payment.

WOULD WE SEND IN DUES FOR 2020 AND 2021?

The Court Order permits the Declarant to collect $36 from the date of filed Order. However, in the event a Homeowner sells their property the Declarant can assert its claim on closing that $93 per month is owed from January 2020. If it does so claim, the Escrow Agent is instructed in the Order to remit $36 per month for every delinquent payment to the Declarant. The Order then instructs the Escrow Agent to remit the disputed $57 portion of the maintenance fee to the Court to be paid out to the Homeowner when the 7th Amendment is found invalid, or to the Declarant if the 7th Amendment is validated.

I PAID THE $93/MO FEE SINCE JAN. 2020, DO THEY OWE ME A CREDIT?

No. Nothing in the Court Order requires the Declarant to give you a credit for your overpayment.

The Declarant is however prohibited from taking adverse action against you for not paying the $57 increase.

Do we automatically have to pay the 12% interest late fee?

The Court Order permits the Declarant to use any legal means to collect the $36 fee. Those include the three possible means set out above, and also application of the 12% interest. Note: 12% interest on $36 would add an additional 36 cents to the monthly fee.

WHAT HAPPENS IF I WANT TO SELL MY PROPERTY AND THE CASE IS STILL ONGOING?

If after not having paid anything for 36 months you sell your property, the closing mechanism will require you to pay the amount claimed by the Declarant to be owing. Any discrepant amount will be placed into the Court registry until the case is settled.

Example: To the date of the Court Order you paid 21 months x $93 to the Declarant or $1953. The Declarant may decide to claim 33 months owing at $93 months or $3069. On closing your sale $1188 or $36 x 33 would be disbursed to the Declarant by the escrow agent. The remaining $1881 or $57 x 33 would be placed into the Court registry and repaid to you when the 7th Amendment is found invalid, or to the Declarant if the 7th Amendment is validated.

THEY CHARGE MY CREDIT CARD $93/MONTH BUT NOW, WILL THEY DROP MY CHARGE TO $36/MO IN OCTOBER?

Not sure. It would be best to contact MJ Management to make sure they make the change.

NOTE: The provision at 4b of the Order “However, nothing in this order shall prohibit the Declarant from collecting the additional $57 than any Homeowners elect to voluntarily pay.” This means if you do not wish to voluntarily pay the disputed $57 and you have set up an automatic payment through a credit card, you MUST contact the Declarant’s agent, MJ Management, LLC to let them know your preference. If you don’t contact the Declarant’s agent, they may reasonably assume that your continued payment of the $93/month is “voluntary.”

WHO PAYS THE LAWYER FEES?

The attorneys have agreed to charge low rates and rely on contributions to a trust fund that has been set up to support this lawsuit. The trust fund is independently managed by an outside attorney, and a committee of plaintiffs reviews every payment. Success will depend on enough Homestead owners deciding to contribute. If we prevail and are awarded fees, all contributions will be refunded pro rata.

what is pro rata distribution?

A pro rata distribution of surplus means that people are paid in proportion to their contribution or interest within the whole trust fund. Example: If the total fund is $100 and a contributor has put in a total of $10, then a pro rata distribution means 10% of the surplus. Learn more

HOW DO I DONATE TO THE TRUST FUND?

Make checks payable to Boundary Bay Law In Trust (Homestead Class Action Ref. #535292897 in Notes).

**MAILING ADDRESS UPDATE**

Mail Payments To:

Boundary Bay Law, PC, 1050 Larrabee Ave,

Suite 104, Box 336

Bellingham, WA 98225.

HOW MUCH LAND MAKES UP THE COMMON OPEN SPACE?

NEW LEGAL UPDATE: Court rules COS does not include areas within the golf course.

According to county records, the common open space totals 8.77 acres. Homestead Park (6.35 acres) adjacent to Fishtrap Creek makes up the majority of the COS. The City maintains the public trail that runs through it. The park at the intersection of Depot Road and Sunrise Drive is 0.33 acres, and the drainage basin on Sunrise is 1.0 acre. The rest of the common open space is made up of small, landscaped areas.

Join your neighbors

If you are a Homestead parcel owner and want control on how membership dues are spent, show your support by approving this lawsuit.

Comments